Many business owners start their business journey by setting up a limited company and it continues as such for many years without thinking about whether the structure can be improved.

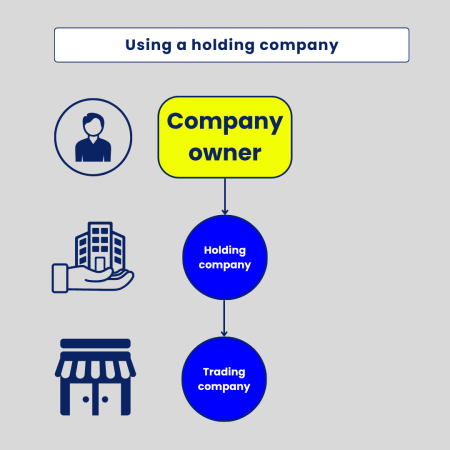

To maximise tax efficiency, minimise risk and be better prepared for a potential future sale or succession, most businesses should consider setting up a holding company structure. This can be very simple and can look at follows:

There are clear benefits to creating a holding company which are discussed below but the important point to note is that holding companies are not just for large corporate groups, SME business owners can take advantage of putting a holding company in place and being able to protect assets from the trade, enable more risky investments to be separated from other assets, and potentially sell the business tax free in the future.

One of the main purposes of the holding company is to split assets off from its trade to protect them from any creditors or future issues with the trading company. This could be investments such as shares, intellectual property or residential/commercial property investments. As businesses assets increase or excess cash arises from profits, it is important that these are protected for the benefit of the owners.

Below are a number of advantages of having a holding company.

1. Protect assets and minimise risk

The best way to set up a holding company is to structure it so that trading entities are held 100% by the holding company and either the holding company owns general investments such as property or intellectual property, or another wholly owned subsidiary of the company owns these investments.

The key here is that should one subsidiary company (say a trading company) realise financial difficulties or go bankrupt, the creditors would usually only be able to access assets from that subsidiary company, and the holding company and other subsidiaries assets would be protected.

Even if a company does not envisage having difficulties in the future, there is always the risk of trading downturns or litigation that can mean the hard work of owners is at risk, a holding company structure protects against this.

2. Tax savings on selling in the future

A holding company should be able to be implemented tax free. There are also the added tax benefits moving forward of generally being able to move assets around a group tax free to help with business plans and risk management.

One of the biggest benefits of a holding company is giving the opportunity to sell the trading business tax free in the future, via a relief known as Substantial Shareholding Exemption. Holding companies can sell trading subsidiaries completely tax free if they hold at least 10% of the shares in the holding company for a period of time (usually 12 months). This enables an owner to sell their trading company tax free, and potential keep the holding company after sale to help with family wealth planning and Inheritance Tax planning, many holding companies become a tax efficient family investment company after a sale of the trading company.

The important point is that a single trading company cannot access this benefit and therefore, setting up a holding company will give this opportunity. A holding company also gives the opportunity to sell a trading company but keep other investments such as perhaps the property the trade operates from, providing rental income for the owners for years to come.

3. Trying riskier investment strategies

A main benefit for using a holding company is protecting assets. This may not just be general investments, but it could be protecting the current trade from risker investments the owners are considering. A holding company will give flexibility here an enable owners to try out new trades in a separate subsidiary, knowing that if the new trade fails, all other assets are protected. This allows business owners to be perhaps more ambitious with new ventures and gives a lot more flexibility when looking at growth.

4. Succession planning

It may be the case that a business owner does not want to sell the business but is considering passing on the business to the next generation. A holding company can help with this by being able to potentially pass different asset and parts of the business to the next generation or allow the next generation to run part of the business in segregation. It may also allow the split of the business if an owner would like to gift parts of the business to different children. Part of having a holding company is keeping these options open for the business owner and enabling effective planning for the future.

Next steps

Most companies would benefit from a holding company structure to give opportunities mentioned above. If you are interested in exploring setting up a holding company, do get in touch