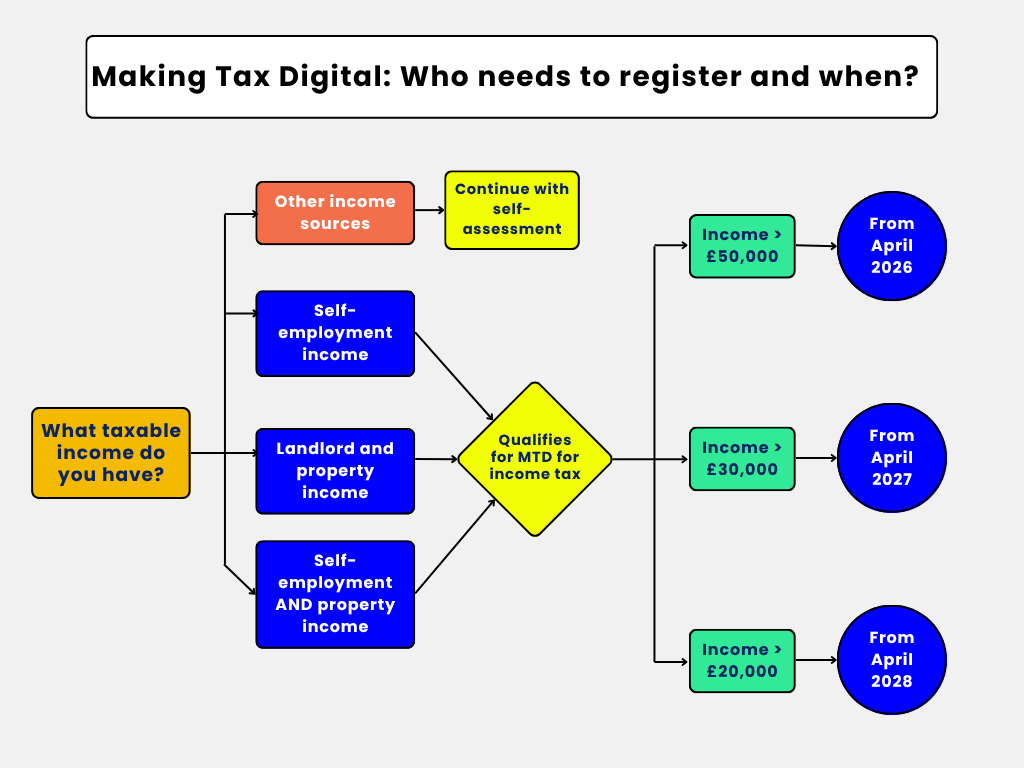

If you’re a sole trader or landlord, the rules around how you report your income tax are changing. From April 2026, Making Tax Digital (MTD) for Income Tax will apply to most individuals with business or property income over £50,000. From April 2027, the threshold drops to £30,000.

It’s a significant shift – but with the right support, it doesn’t have to be overwhelming. This hub brings together our latest insights, FAQs and practical guidance to help you understand what’s changing, what you’ll need to do, and how Gravita can guide you through the process. Whether you’re looking for clarity, reassurance or next steps, you’ll find it here.