Webinar recording: Doing business between the EU and the UK

When thinking about doing business between the UK and EU, there are many factors to consider, both as an individual and a business. These include social security, wage taxes, exit taxes, permanent establishment, and withholding taxes, to name a few. Thomas Adcock, Gravita Tax Partner, and Janneke Speetjens, Attorney-at-law and Tax Consultant at PSP München (lawyers, auditors, tax consultants and […]

Private schools VAT under a labour government: Implications and strategies

Written by VAT Partner, Sandy Cochrane The prospect of VAT being applied to private school fees has generated significant buzz in the media. With a newly elected Labour government, this potential change has become a reality, impacting the families paying for education and the private schools themselves. In this article, we explore the implications of […]

Gravita Tech Talks: Transaction Triumphs (Video)

Gravita hosted an insightful panel discussion ‘Transaction Triumphs’ and we are thrilled to present a video that encapsulates the essence of this tech event. The event brought together a panel of experts who shared their invaluable experiences and strategies that they believe make or break a deal throughout a transactions journey. The video will […]

VAT Update on Hotel La Tour Appeal – VAT is not recoverable on share sale costs

Written by VAT Partner, Sandy Cochrane Last week marked the conclusion of the Hotel La Tour VAT case, with the Court of Appeal ruling in favour of HMRC. After facing two prior setbacks, HMRC has now secured a significant win through the Court of Appeal. We await to see whether Hotel La Tour will seek […]

Navigating the UK Tax Landscape: Providing Advice for Non-Doms

As you may be aware there have been a number of important changes announced, which will directly affect the basis of UK taxation of those Non-Domiciled in the UK from 6 April 2025 onwards. We are currently assisting clients to ensure they are prepared for the changes. If you have any Non-Dom clients or […]

Hotel La Tour VAT Appeal – Could the outcome affect you?

Written by VAT Partner, Sandy Cochrane The Hotel La Tour VAT recovery case was scheduled for April 10, 2024. The outcome of the decision could potentially open the door for businesses across various sectors to reclaim VAT on the costs of selling the shares of a subsidiary that have taken place in the last four […]

Payroll Tax Year Changes 2024/25

The new fiscal year has brought about changes to payroll regulations, which demand attention and proactive adjustment to make sure your payroll is compliant, and your staff supported. In this article we delve into the key payroll changes for 2024/2025, ensuring you are informed and prepared, so you can navigate these changes seamlessly. […]

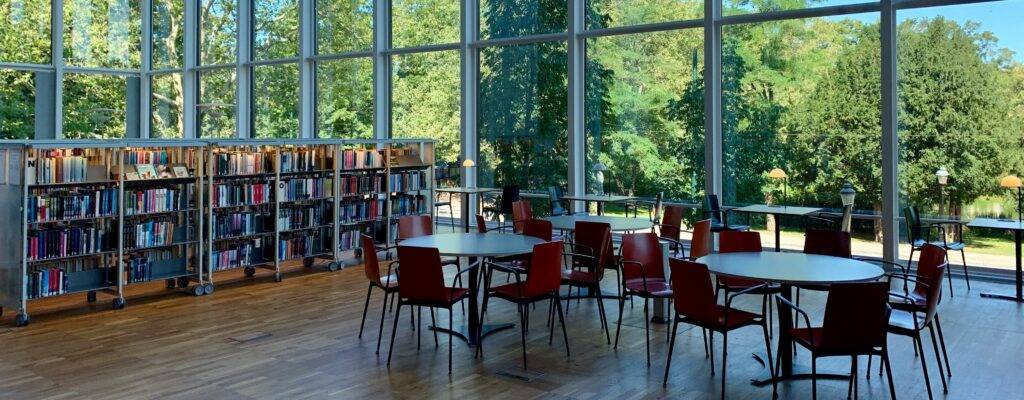

More information on visiting the Gravita office

Visiting us at Aldgate Tower When you are arriving at Aldgate Tower, please speak to Reception, who will let your Gravita contact know you have arrived and will provide you with access up to the 12th floor. Please make sure you have a meeting booked with your Gravita contact prior to arriving, as Reception must […]

UK company size monetary thresholds to rise by 50%

Written by Audit Partner, Luke Metson In a welcome move to reduce complexity and obligations, with particular regard to non-financial reporting, the UK company size thresholds will be changed for financial years starting on or after 1 October 2024. Non-financial reporting has become increasingly complicated and therefore time consuming, requiring a diverse skill set and […]

Inheritance Tax changes for Non-Doms

Written by Tax Partner, Michaela Lamb Along with other sweeping reforms to the Non-Dom rules, the Government announced that it would be making changes to the UK Inheritance Tax system too, shifting towards a residence rather than domicile basis. This is currently in consultation, so we will not know exactly what the Government is […]