Looking for more insights on getting your foundational hires right? Join our upcoming webinar ‘What Tech Founders Get Wrong About Risk and How to Fix It Early‘ (10th September, 10-11am) where we’ll explore how strategic decisions around legal, financial, and people foundations can prevent major headaches as you scale.

When your business reaches that pivotal moment where you realise you need more finance capability, the default response is usually the same: “We need to hire someone.” But what if that instinctive reaction is limiting your options? What if the smartest CFOs are rethinking the hire-first mentality entirely?

The reality is that there are strategic alternatives worth considering, such as outsourcing and offshoring – approaches that might not only solve your immediate problems but set you up for sustainable, scalable growth. It’s time to challenge the assumption that your first finance hire needs to be a hire at all.

The startup dilemma when finance becomes a bottleneck

If you’re running a growing business, this scenario will sound familiar. You’re brilliant at what you do – whether that’s running restaurants, recruiting executives or building software – but you’re drowning in finance admin. You find yourself spending hours on tasks that feel important but aren’t moving the needle on your core business.

The warning signs are everywhere: manual processes eating up your time, inconsistent reporting that makes decision-making harder, and a nagging feeling that you don’t have proper oversight of your numbers. Perhaps most frustratingly, this lack of financial visibility is hampering your ability to make confident growth decisions.

Many business owners recognise this pain but make the mistake of waiting until they desperately “need” someone before addressing it. By then, they’re firefighting rather than building foundations – and that reactive approach rarely leads to optimal outcomes.

Challenging the default hire versus outsource decision matrix

When most businesses think about solving their finance capacity problem, they immediately jump to recruitment. On the surface, it seems logical: hire a management accountant or finance manager, give them a desk, and let them sort everything out.

But the true cost of hiring goes far beyond salary. You’re looking at benefits, training time, management overhead and the ongoing responsibility of keeping that person busy and engaged. Then there’s the skills limitation issue – that first hire is likely to be a generalist when what you might actually need is access to specialist knowledge across multiple areas.

Perhaps most importantly, there’s the scalability question: what happens when you outgrow that first hire? Do you simply add another person? And another? Before you know it, you’re throwing bodies at problems rather than building efficient, scalable processes.

The outsourcing alternative

The alternative approach flips this thinking on its head. Instead of hiring first and building processes around people, you start by building robust, scalable processes and then determine the most efficient way to deliver them.

This approach gives you immediate access to specialist knowledge and proven systems. You’re not starting from scratch or hoping your new hire knows best practice – you’re plugging into established expertise. The scalability is built in from day one, and crucially, you’re not taking on the management overhead and training requirements that come with new employees.

The business lifecycle perspective

Understanding where you are in your business lifecycle is crucial to making the right decision about your finance function.

Startup phase opportunities

| If you’re in the early stages of growth, you have a unique opportunity to set foundations right from the start. This is when you can avoid falling into the “throw bodies at problems” mentality that plagues many scaling businesses.

Consider this: wouldn’t it be better to build cookie-cutter approaches for future locations or expansions right from the beginning? When processes are documented, automated, and proven, scaling becomes a matter of replication rather than reinvention. |

Growth phase considerations

| For businesses in the growth phase, the pain points become more acute. Your current systems start breaking under pressure – management accounts take too long to prepare, intercompany transactions become muddled, and you lose confidence in your numbers.

Sometimes external factors create unexpected opportunities. Take the example of a management accountant going on maternity leave – rather than simply covering the role, this becomes a chance to redesign the entire finance function. When they return, instead of stepping back into a mess of manual processes, they can take on the strategic role they were actually hired to do.

Multi-entity and international expansion add layers of complexity that make the scalability question even more pressing. Do you really want to replicate problematic processes across multiple territories? |

Building for scale through technology-enabled approaches

The most successful finance transformations start with a fundamental question: if we were building this from scratch today, how would we do it?

Core components of a scalable finance function

Modern finance functions are built on several key foundations. A unified chart of accounts across all entities ensures consistency and eliminates the confusion that comes from different people implementing different approaches over time.

Automated data capture and processing removes the manual bottlenecks that plague traditional setups. When invoices can be processed automatically using OCR technology and predefined rules, you eliminate both the time lag and the human error that comes with manual data entry.

Real-time reporting and consolidation capabilities mean decision-makers can access current information rather than waiting weeks for management accounts that are already out of date. Proper intercompany reconciliation systems ensure that multi-entity businesses have clean, trustworthy numbers across all their operations.

The hybrid model advantages

The most sophisticated approaches combine automation with offshore processing while keeping judgement and review functions onshore. This isn’t about simply sending work overseas to save money – it’s about creating an intelligent division of labour that maximises efficiency and quality.

By automating data capture and processing offshore, you free up onshore resources to focus on analysis, interpretation, and strategic input. The key is creating clear handover processes and documentation so everyone knows exactly what they’re responsible for and when.

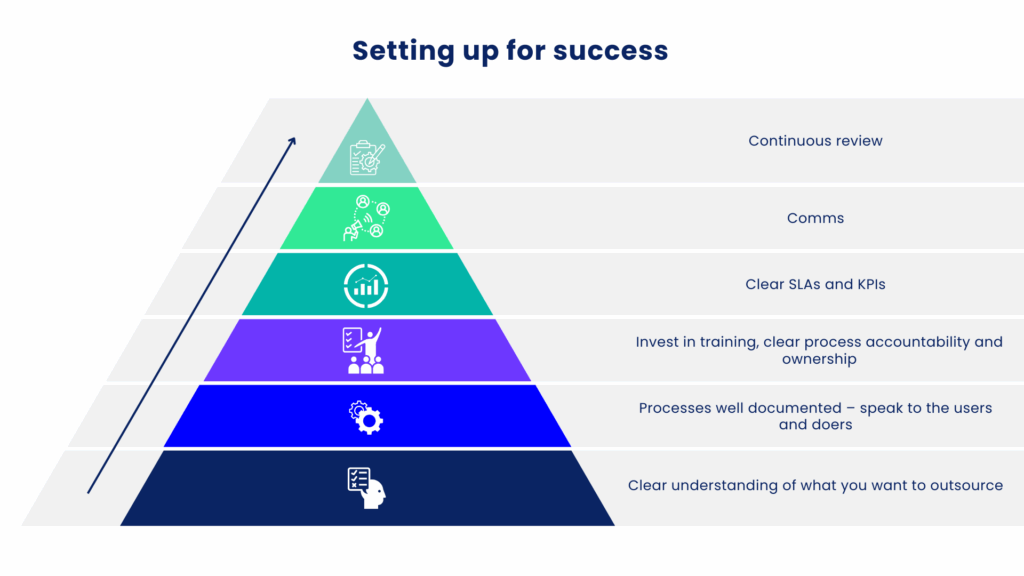

A pyramid approach

Think of successful implementation as a pyramid. At the base, you need a clear understanding of what you want to achieve. Too often, businesses start with tactical questions like “can you fix our chart of accounts?” when the real question is “how do we build a finance function that supports our growth ambitions?”

The next level is documented standard operating procedures. You need to understand not just what people think happens in your business, but what actually happens on the ground. Where are the workarounds? Where do processes break down? Only by documenting the reality can you design something better.

Training and accountability structures ensure everyone knows their role and how to execute it properly. Service level agreements create clear expectations around timing and delivery – when will invoices be processed, by whom, and to what standard?

Finally, continuous review and improvement cycles prevent the whole system from becoming static. As your business evolves, your finance function should evolve with it.

Key success factors

The most successful implementations start with outputs rather than inputs. Instead of asking “what systems do we need?”, ask “how do we want to report our business?” Work backwards from there to determine what needs to be captured and how.

Build from foundations up rather than patching existing problems. It’s tempting to fix issues piecemeal, but lasting success comes from addressing root causes rather than symptoms.

Create scalable, repeatable processes that can be replicated as you grow. And establish clear communication channels across time zones – success lives or dies by process and communication when you’re working across borders.

Beyond bookkeeping and the full finance function spectrum

One of the biggest misconceptions about outsourced finance is that it’s just bookkeeping. Modern outsourced finance functions can deliver the full spectrum of financial services: management accounting and forecasting, scenario planning and budgeting, multi-territory compliance and reporting, strategic financial analysis, and even entry and exit planning support.

This breadth of capability is often impossible to access through a single hire, especially in the early stages of business growth. By outsourcing, you’re buying access to a team of specialists rather than hoping one person can cover all bases.

Making the decision through evaluation criteria for CFOs

When outsourcing makes sense

Outsourcing tends to work best when you have limited internal finance expertise and need to get up to speed quickly. If you’re experiencing rapid growth or planning expansion, the scalability benefits become particularly attractive.

Complex multi-entity structures almost always benefit from outsourced approaches because the specialist knowledge required – particularly around intercompany reconciliations and consolidations – is expensive to build in-house. Similarly, if you need immediate access to specialist knowledge, outsourcing can deliver that from day one.

When hiring might be better

There are situations where direct hiring makes more sense. If your business requires very specific industry expertise that needs to be embedded in day-to-day operations, an internal hire might be preferable.

Highly confidential or strategic work might need to stay in-house, and some business owners simply have a strong preference for direct control over all aspects of their operation. Finally, if you have sufficient volume and complexity to justify full-time specialist roles, the economics of hiring might work in your favour.

Cost-benefit analysis framework

The decision shouldn’t be made on headline costs alone. Consider the total cost of ownership: salary plus benefits plus training plus management time versus the all-in cost of outsourcing.

Think about scalability and future flexibility. Can you easily scale your chosen approach up or down as your business evolves? Consider risk mitigation too – are you creating dependency on specific individuals or building robust processes that can survive personnel changes?

Perhaps most importantly, consider time to value. How quickly can each approach deliver the capabilities you need? Recruitment and training can take months; good outsourcing relationships can deliver immediate value.

Conclusion

The strategic advantage of thinking beyond traditional hiring isn’t just about cost or convenience – it’s about building a finance function that can scale with your ambitions rather than constraining them.

The best time to consider these alternatives isn’t when you’re desperately firefighting, but before you think you need them. By then, you’re making strategic choices rather than reactive ones, and you’re setting foundations for sustainable growth rather than patching immediate problems.

The question isn’t whether outsourcing is better than hiring – it’s whether you’re considering all your options before defaulting to what everyone else does. In a competitive business environment, that strategic thinking might just be the edge you need.

Key takeaways

- Consider outsourcing before your first hire, not after – you’ll make better strategic decisions when you’re not firefighting

- Focus on building scalable processes, not just filling immediate gaps in capacity

- Technology-enabled solutions can provide immediate access to specialist capability that would take years to build in-house

- The real question isn’t whether to outsource, but what parts of your finance function add most value when kept in-house

Are you evaluating your current finance function’s ability to scale with your growth plans? The decisions you make now will determine whether your finance function becomes a competitive advantage or a constraint on your ambitions.