VAT and Sport …Private Tuition

Gravita’s tax consultant, Tim Palmer, gives his experiences relating to sporting private tuition and VAT. Many years ago, I was presenting a tax update lecture in Central London. During the course of the lecture, I reminded the delegates that if they had an individual client who was giving private tuition in a subject ordinarily taught […]

Mixed use property portfolio – 7th November 2023 deadline to submit certain annual adjustments for VAT periods ending on 30 September 2023

Written by VAT Partner, Sandy Cochrane It is commonplace for taxpayers to own UK property which contains a mixture of residential and commercial. For example, where a building will have commercial premises on the ground floor, and residential premises above. These taxpayers are likely to be partially exempt for UK VAT purposes, receiving taxable income […]

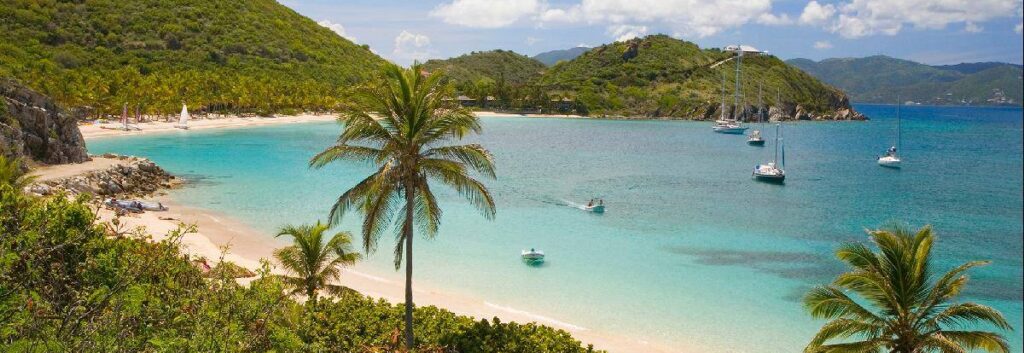

The current outlook for the travel industry

Written by Audit Partner, Luke Metson With the travel industry recovering from the Covid pandemic and travellers facing new challenges, such as high inflation, increasing interest rates and high energy bills, there is a general uncertainty as to their appetite for travel. Whilst the ‘cost-of-living’ crisis is putting pressure on travellers’ finances, many do still […]

Mitigating some risks with SEIS and EIS tax investment schemes

Written by Tax Partner, Toby Hermitage The SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) schemes provide valuable tax incentives for investors who subscribe to shares in particular companies. These reliefs make fundraising for newer and smaller companies much easier as the investor’s downside risk is mitigated and upside benefit is exempt from […]

CBW, now part of Gravita, named as a top 25 mid-sized company to work for in the UK, by ‘Best Companies’ 2023 survey

For the second year running, we are delighted to announce that CBW, now part of Gravita, has been awarded a 1* accreditation, classifying us as ‘a very good company to work for’. This classification shows not only that Gravita takes workplace engagement seriously, but also plays its part in helping to make the world a […]

Business property relief: IHT exemptions for business activity

Written by Tax Partner, Parminder Chattha Inheritance Tax (IHT) is chargeable on the value of an estate when someone dies, although it could also be chargeable on certain lifetime transfers, as well on property held within a relevant property trust. The rate of tax is 40% above a certain exempt amount, and there are various […]

Rules for the reporting and payment of capital gains tax for the disposal of UK residential property

Written by Tax Partner, Michaela Lamb HMRC introduced new rules for the reporting of capital gains tax from 6th April 2020. We have set out below a list of FAQs which we hope will assist you in understanding these rules. I have sold a UK property, what do I need to tell HMRC? If […]

World Environmental Day: Empowering change with Computer Aid

This week we have celebrated World Environmental Day, a day to encourage awareness and action for the protection of the environment. As we commemorate World Environmental Day here at Gravita, we are reflecting on addressing the environmental challenges we face and continue to look for ways to increase sustainability and play our part in creating […]

Associated companies: Companies paying tax sooner and more often

Written by Tax Partner, Thomas Adcock From 1st April 2023, the number of companies that your company is associated to will increase the risk that not only will those companies have to pay a higher rate of tax on their profits, but that this tax may have to be paid more regularly and far sooner. […]

Six inheritance tax myths debunked

Written by Tax Partner, Parminder Chattha It raises a large amount of money for the government Total inheritance tax (IHT) receipts in FY21/22 equated to £6.1bn and is forecast to rise in 2023/24 to £7.2bn. This was up 14% from the prior financial year by £729m. However, total tax receipts for 2021 and 2022 equated […]