Staff summer parties, and the treatment of VAT

Written by VAT Partner, Sandy Cochrane With summer approaching, you may be starting to plan your work summer party. At Gravita, we are in the process of securing our summer venue as it is so important for us to get together as a team and have an evening of catching up, laughter, food, drinks, and […]

Generous Employer Pension? Beware of the hidden tax traps…

Written by Tax Partner, Michaela Lamb Many employers now offer pension contributions as part of their remuneration packages – in fact, following the introduction of Auto Enrolment Pensions in October 2012, you and your employer are obliged to make contributions to a pension scheme, unless you specifically opt out. For most people there is […]

If you wish to make voluntary NI contributions to the ‘new state pension’ you may benefit from the current extension, but must now act before 5 April 2025

This extension could make all the difference in ensuring you receive all or some of the ‘new state pension’ and you should act now. For those retiring on or after 6 April 2016 In March 2023 HMRC announced an extension (to 31 July 2023) of the 5 April 2023 deadline for making additional National […]

VAT and sport: Private tuition and coaching

VAT is a knotty subject, and it extends to sport and private tuition. Understanding the VAT exemption for private tuition Under UK VAT legislation, private tuition provided by an individual acting in a personal capacity, either as a sole trader or a member of a partnership, can be exempt from VAT if the subject is […]

Mixed use property portfolio – 7th November 2023 deadline to submit certain annual adjustments for VAT periods ending on 30 September 2023

Written by VAT Partner, Sandy Cochrane It is commonplace for taxpayers to own UK property which contains a mixture of residential and commercial. For example, where a building will have commercial premises on the ground floor, and residential premises above. These taxpayers are likely to be partially exempt for UK VAT purposes, receiving taxable income […]

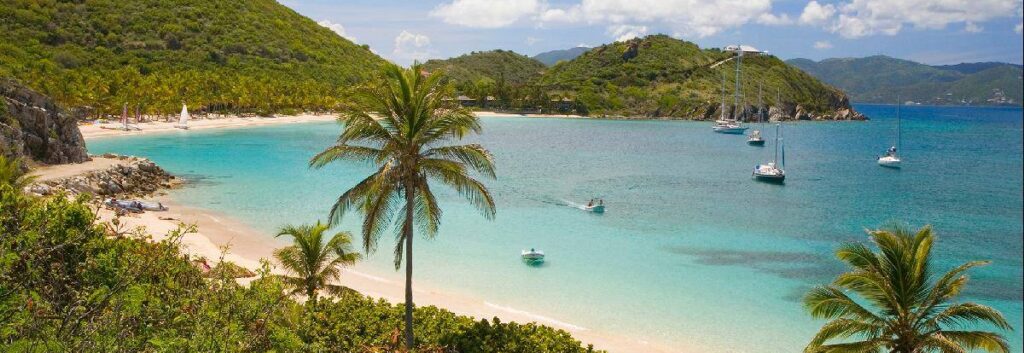

The current outlook for the travel industry

Written by Audit Partner, Luke Metson With the travel industry recovering from the Covid pandemic and travellers facing new challenges, such as high inflation, increasing interest rates and high energy bills, there is a general uncertainty as to their appetite for travel. Whilst the ‘cost-of-living’ crisis is putting pressure on travellers’ finances, many do still […]

Mitigating some risks with SEIS and EIS tax investment schemes

Written by Tax Partner, Toby Hermitage The SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) schemes provide valuable tax incentives for investors who subscribe to shares in particular companies. These reliefs make fundraising for newer and smaller companies much easier as the investor’s downside risk is mitigated and upside benefit is exempt from […]

CBW, now part of Gravita, named as a top 25 mid-sized company to work for in the UK, by ‘Best Companies’ 2023 survey

For the second year running, we are delighted to announce that CBW, now part of Gravita, has been awarded a 1* accreditation, classifying us as ‘a very good company to work for’. This classification shows not only that Gravita takes workplace engagement seriously, but also plays its part in helping to make the world a […]

Business property relief: IHT exemptions for business activity

Written by Tax Partner, Parminder Chattha Inheritance Tax (IHT) is chargeable on the value of an estate when someone dies, although it could also be chargeable on certain lifetime transfers, as well on property held within a relevant property trust. The rate of tax is 40% above a certain exempt amount, and there are various […]

Rules for the reporting and payment of capital gains tax for the disposal of UK residential property

Written by Tax Partner, Michaela Lamb HMRC introduced new rules for the reporting of capital gains tax from 6th April 2020. We have set out below a list of FAQs which we hope will assist you in understanding these rules. I have sold a UK property, what do I need to tell HMRC? If […]