VAT and the Construction Industry – Client webinar

Sandy Cochrane, Gravita’s head of VAT, will be presenting a 45 minute webinar on Thursday 12th October from 9:00am – 9:45am, addressing and explaining the main VAT problem areas that both contractors and subcontractors currently face in the construction industry. The areas she intends to cover will include: General overview The Domestic Reverse charge: understanding […]

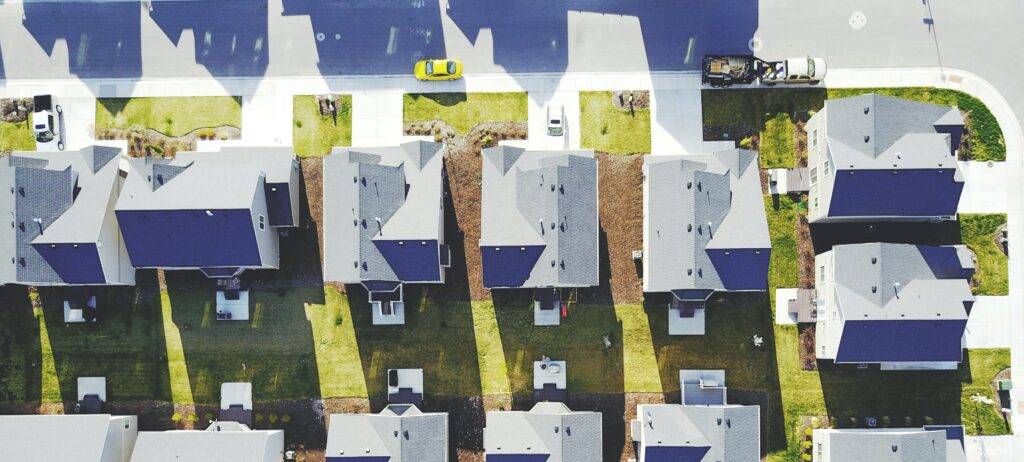

Should I incorporate my buy to let property business?

Written by Tax Partner, Michaela Lamb Since the announcement made in the 2015 Summer Budget introducing a restriction on the tax relief provided on mortgage interest for individuals, the most common question we have been asked is “Should I incorporate my Buy to Let Property Business?”. Translated this is simply, “should I put my property […]

Webinar: VAT and the Construction Industry

Sandy Cochrane, Gravita’s head of VAT, will be presenting a 45 minute webinar on 3rd October 2023 addressing and explaining the main VAT problem areas that both contractors and subcontractors currently face in the construction industry. The areas she intends to cover will include: The domestic reverse charge: understanding the supply chain and whether the […]

What is a Family Investment Company (FIC) and is it right for me?

Watch our explainer video A Family Investment Company (FIC) is a private company which is often used to move wealth to the next generation(s) without suffering Inheritance Tax (IHT), the FIC’s shareholders are family members. It can be used as an alternative to a family trust and acts to facilitate future succession planning. It […]

Gravita Audit debuts halfway up the AIM rankings

The AIM Advisers Rankings Guide is published each quarter by Adviser Rankings Limited. It contains details of institutional advisers and their quoted AIM clients. These lists are drawn not only from UK and Channel Island domiciled companies but also from the growing number of overseas companies that are joining London’s Alternative Investment Market. […]

Stamp Duty Land Tax (SDLT) – A Beginner’s Guide

What is SDLT? SDLT is a capital tax payable by the purchaser of both freehold and leasehold interests in property and land situated in England or Northern Ireland. It is calculated by reference to a percentage(s) of the chargeable consideration. This would usually be the property’s purchase price though it can also include the release […]

Employee Ownership Trusts (EOTs) – Tax efficient exit and succession planning

Written by Tax Partner, Thomas Adcock What is an EOT? An EOT is a special form of employee benefit trust which was introduced by the Government in 2014 to further encourage and support employee ownership of UK trading companies, via an indirect holding. EOTs are an alternative form of company exit for shareholders […]

Bringing fresh clarity to Gravita

As we wrote to clients a few weeks ago, we’re taking steps to simplify both Gravita’s brand image and corporate structure. This follows a series of new firms joining Gravita which have brought greater scale, depth, and an ability to deliver a wider range of services to our clients. The latest corporate development […]

UK employee share schemes: Enterprise Management Incentives (EMI)

Written by Tax Partner, Michaela Lamb Whilst there are many ways of incentivising and retaining key employees, the Enterprise Management Incentive (EMI) scheme remains one of the most tax efficient ways to do this because of the very generous tax reliefs associated with the scheme. In addition, these schemes are entirely flexible and gives the […]

Why some clients choose to outsource their finance function in the short or long term.

Written by Accounts and Outsourcing Partner, Nyall Jacobs At Gravita we offer many specialities that a growing business needs to maximise its chances to get to the next stage in its life cycle. Gravita’s Outsourced FD function This offering includes an outsourced FD, who reports to the business and who comes with their own accounts […]